What Is a Cost Segregation Study? A Beginner’s Guide

Download the PDFIf you’ve recently purchased or built a commercial property, you might be sitting on a tax-saving opportunity without even knowing it. Enter the cost segregation study—a powerful tool used by property owners to accelerate depreciation deductions, improve cash flow, and reduce tax liability. But what exactly is it, and how does it work? Let’s break it down in simple terms, with examples, graphs, and numbers to make it crystal clear.

The Basics: What Is Cost Segregation?

When you buy a commercial property—like an office building, warehouse, or rental unit—the IRS typically lets you depreciate the cost over a long period: 39 years for commercial buildings or 27.5 years for residential rentals. That’s a slow drip of tax benefits. A cost segregation study changes the game by identifying parts of the property that can be depreciated faster—think 5, 7, or 15 years instead of decades.

The process involves hiring a specialist (usually an engineer or accountant) to analyze your property and “segregate” its costs into different buckets:

- Building structure (39 or 27.5 years)

- Personal property (5 or 7 years, like furniture or fixtures)

- Land improvements (15 years, like parking lots or landscaping)

By shifting costs into these shorter-lived categories, you can claim bigger tax deductions sooner.

Why It Matters: Cash Flow and Taxes

Accelerating depreciation doesn’t change the total deductions you get—it just front-loads them. This boosts your net present value (NPV) because money today is worth more than money tomorrow due to inflation and investment opportunities. Let’s see how this plays out with an example.

Example: The $1 Million Property

Imagine you buy a small office building for $1 million (excluding land). Without cost segregation, you’d depreciate the entire amount over 39 years using straight-line depreciation. At a 30% tax rate, here’s what happens:

- Annual depreciation: $1,000,000 ÷ 39 = $25,641

- Annual tax savings: $25,641 × 30% = $7,692

- Total savings over 6 years: $7,692 × 6 = $46,152

Now, let’s say a cost segregation study reclassifies the property:

- 75% ($750,000) stays at 39 years (structure)

- 15% ($150,000) moves to 5 years (fixtures, carpeting)

- 10% ($100,000) moves to 15 years (parking lot, landscaping)

Here’s the new breakdown:

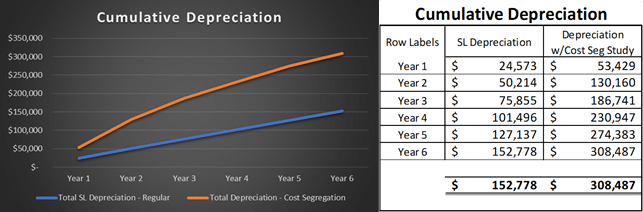

- Without a Cost Segregation study, depreciation is flat producing only $25,641 per year. Tax Savings over a 6 year span only generates $152,778 in depreciation (treated as a deduction) and $45,833 in cash not spent on Taxes.

- With a Cost Segregation study, depreciation increased by +200% per year. Over 6 years, Tax Savings generated $308,487 in depreciation (treated as a deduction) and $92,546 in cash not spent on Taxes.

Over 6 years, total depreciation cumulatively grows to $308,487 instead of only $152,778, yielding tax savings of $92,487—more than double the standard method!

NPV Calculation: Is It Worth It?

Let’s calculate the NPV of tax savings over 5 years, assuming a 5% discount rate (a common rate reflecting the time value of money).

- Standard method: $7,692 annually

NPV = $7,692 × [(1 – (1 + 0.05)^-5) ÷ 0.05] = $33,366 - Cost segregation:

Year 1: $20,615 ÷ (1.05)^1 = $19,633

Year 2: $20,615 ÷ (1.05)^2 = $18,698

Year 3: $20,615 ÷ (1.05)^3 = $17,807

Year 4: $20,615 ÷ (1.05)^4 = $16,959

Year 5: $20,615 ÷ (1.05)^5 = $16,151

NPV = $89,248

Difference: $89,248 – $33,366 = $55,882 in additional value over 5 years.

Tax Implications at a 30% Rate

At a 30% tax rate, every dollar of depreciation saves you $0.30 in taxes. Cost segregation amplifies this early on:

- Year 1 savings: $16,029 vs. $7,692—a $8,337 boost (Cost Seg Study & no Bonus Depreciation)

- Year 1 savings: $80,529 vs. $7,692—a $72,837 boost (Cost Seg Study & Bonus Depreciation)

- Catch-up later: After 5 years, the standard method keeps chugging along, while cost segregation deductions taper off. But the early savings can be reinvested.

One caveat: If you sell the property, “recapture” rules tax the accelerated depreciation at a higher rate (up to 25%). Still, the time value of money often outweighs this downside.

Who Should Use It?

Cost segregation works best for:

- New property owners (or those who’ve renovated)

- High-income taxpayers in the 30%+ bracket

- Properties costing $150,000 or more per property

Final Takeaway

A cost segregation study isn’t magic—it’s just smart tax planning. By speeding up depreciation, you unlock cash flow today instead of waiting decades. With tax savings like $92,487 versus $45,833 over 6 years (in our example), and an NPV boost of over $55,000, it’s worth a chat with your accountant. The numbers don’t lie—sometimes, a little upfront effort pays off big.

Click here for Free Cost Seg Estimate